home office deduction worksheet

Home Office Deduction - Definition, Eligibility & Limits - ExcelDataPro. 9 Pics about Home Office Deduction - Definition, Eligibility & Limits - ExcelDataPro : CPA Prepared Home Office Deduction Worksheet | Etsy, Simplified Home Office Deduction: When Does It Benefit Taxpayers? and also Anchor Tax Service - Medical Deductions.

Home Office Deduction - Definition, Eligibility & Limits - ExcelDataPro

exceldatapro.com

exceldatapro.com

exceldatapro deduction simplified eligibility irs feet

Anchor Tax Service - Medical Deductions

www.anchor-tax-service.com

www.anchor-tax-service.com

deductions deduction

Home Office Deduction - Definition, Eligibility & Limits - ExcelDataPro

exceldatapro.com

exceldatapro.com

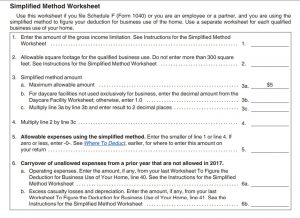

simplified method office worksheet deduction expenses allowable exceldatapro square feet irs calculate provided below using use

Anchor Tax Service - Truck Driver Deductions

www.anchor-tax-service.com

www.anchor-tax-service.com

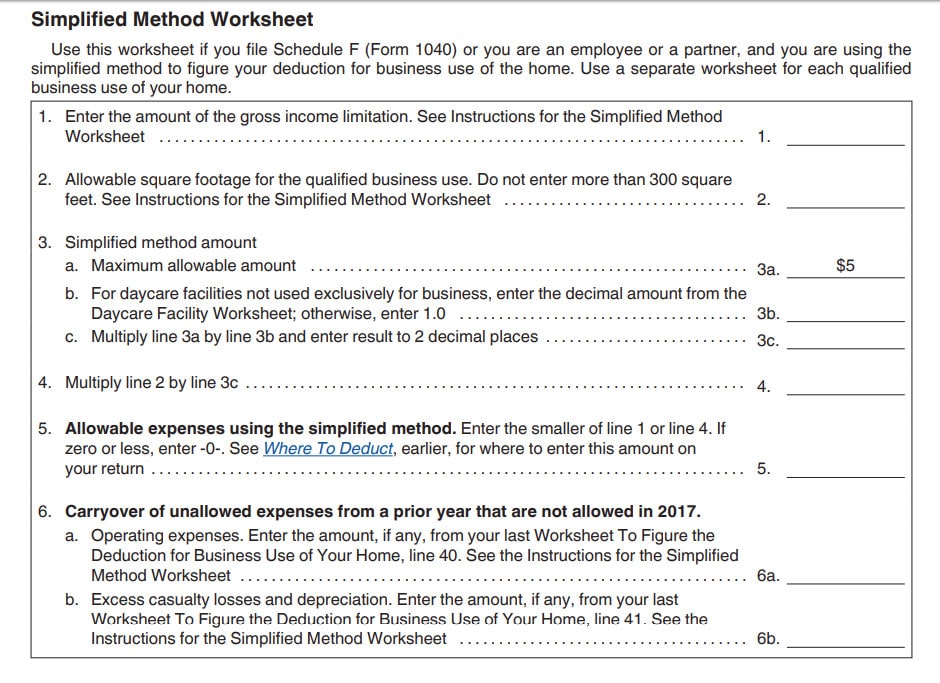

tax deductions worksheet spreadsheet business preparation driver truck deduction excel trucker electrical service calculation load sheet anchor inside allowance meal

Introduction To Deducting Home Business Expenses | Toronto Tax

accountant-toronto.ca

accountant-toronto.ca

expenses office business tax form expense accountant toronto list deducting categories corporation eligible jenny

Home Office Expense Spreadsheet Printable Spreadsheet Home Office Tax

db-excel.com

db-excel.com

office expense spreadsheet deduction worksheet expenses excel tax

CPA Prepared Home Office Deduction Worksheet | Etsy

www.etsy.com

www.etsy.com

deduction

Home Office Tax Deduction Still Available, Just Not For COVID-displaced

deduction taxes daycare dontmesswithtaxes displaced employees

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

www.thetaxadviser.com

www.thetaxadviser.com

tax deduction office method simplified benefit deductions self income business itemized employment regular loss taxpayers does schedule items current

Simplified home office deduction: when does it benefit taxpayers?. Anchor tax service. Simplified method office worksheet deduction expenses allowable exceldatapro square feet irs calculate provided below using use